Technological dimensions of the automotive industry in producing light weight components

Industry Facts

- » The global lightweight materials consumption for transportation equipment in 2006 was 42.8 million tons/$80.5 billion that has increased above 9% i.e. 68.5 million tons/$106.4 billion by 2011.

- » The above metal quantity largest percentage accounts high strength steel and followed by aluminium & plastics.

- » The passenger cars and light trucks among motor vehicles are the largest end user segment made of lightweight materials.

Materials role in lightweight materials for automotives

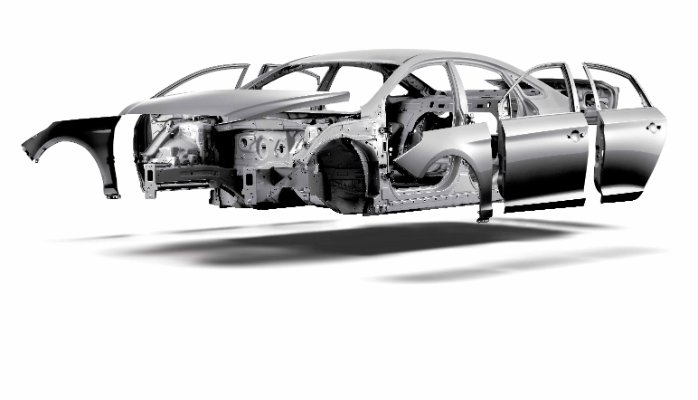

Steel: Among the metals and composites, steel is the most adorable component that has been playing an important role in the automotives manufacturing process. It is the major interest area for steel industry and component suppliers who are investing heavily in its innovation. The inherent capability of steel to absorb impact energy in a crash situation led the material to be often a first choice for the automotive designers. While the components in a body in white structure should undergo tests that proves the metal be able to absorb or transmit impact energy in a crash situation to decide about the suitability of the materials for automotive application.

ThyssenKrupp Steel Europe set up modernized mills to produce high tensile steels for lightweight automotive construction, starting material for tin-plate, plus steels for oil and gas pipelines, and electrical steel. While, Chrysler and many foreign carmakers depends on zinc-iron coatings, which can be made by electro galvanizing or by producing galvaneal, which is an inline annealed galvanized steel, on hot dip lines.

In collaboration with Sumitomo Metal Industries and Aisin Takaoka, Mazda Motor has become the first automaker to successfully develop vehicle components using 1,800 MPa ultra-high tensile steel. Its CX-5 comes under a lighter vehicle, have more rigid chassis largely made of high-tensile steel, that enables the car to feel solid and composed when slogging through rough terrain, either roads or trails. Another car maker Honda has come up with Accord Euro that is manufactured 50% from high tensile steel.

Aluminium: Another metal that offers considerable potential to reduce the weight of an automobile body is aluminium, which is most commonly recycled material in the world. Aluminiun can be employed in automotive powertrain, chassis, alloys and body structures.

There is a substantial usage of aluminium in past years and Sears research says that 110kg of aluminium used in vehicle during 1996 and estimated to rise to 250 – 340 kg that includes with or without taking body panel or structure applications by 2015. While the predictions are also saying about aluminium applications in trunk lids, hoods, and doors hanging and the recent examples are power trains, body structure, chassis, and air conditioning. Present key trend of the material is for engine blocks, which is one of the heavier parts that are being switched from cast iron to aluminium resulting prominent weight reduction.

The recent development is applying wrought aluminium over aluminium castings and also finding wrought aluminium applications in heat shields, bumper reinforcements, air bag housings, pneumatic systems, sumps, seat frames, side impact panels, etc,.

The recent Mercedes-Benz SL gets an aluminium body shell weight is made up of 44% cast aluminium, 17% aluminium sections, 28% aluminium sheet metal, 8% steel and 3% of other materials. It weighs less than its predecessor because of extensive use of aluminum construction in retractable-hardtop convertible, but priced more.

According to Mercedes-Benz the aerodynamic improvements in this model not only reduce drag, but also offer a quieter ride, with top down less wind in the cabin, and even less dirt buildup on the side windows. However, the relative crash worthiness of two like vehicles, one with more aluminum, the other with more steel, will provide the steel car with a safety advantage. While, the on a pound per pound basis, aluminum absorbs two times as much crash energy as typical automotive steel the argument goes on by stating as vehicles lighten up aluminum will help with fuel economy, performance and safety.

Magnesium: Compared to aluminium & steel/cast iron, magnesium is 33% & 75% lighter respectively. While, the corrosion resistance of modern, high-purity magnesium alloys is better than that of conventional aluminium die-cast alloys.

But magnesium components in automotive products have many mechanical/physical property disadvantages that require unique design for application and the modulus and hardness of magnesium alloys is lower than aluminium and the thermal expansion coefficient is greater. However, it should be noted that suitable ribbing and supports often can overcome the strength and modulus limitations.

After EU declared on CO2 emissions to less than 120g/kg, magnesium has become the extensively promoted and used lightest metal in automotives in Europe. The cost reduction idea in the development fabricated magnesium components aimed to bring the parts prices about twice those of the aluminium parts.

Plastics and composites: Starting with 1953 Corvette polymer composite materials have been a part of the automotive industry. The preference on these materials grown because of their shortened lead times, lower investment costs, reduced weight and parts consolidation opportunities, corrosion resistance, design flexibility, material anisotropy, and mechanical properties relatively to conventional steel fabrication.

However, the impediment took place because of the high material costs, slow production rates, concerns about recyclability and several factors have hindered large scale automotive applications of polymer composites. The cost of composite materials is usually up to 10 times higher when using carbon fibres than those of conventional metals and hence the main targets for future development must be the use of hybrid composites, which incur low-cost. BMW and VW gave a head start in the use of carbon fiber structures in their vehicles.

At an accelerated rate, steel structures are being replaced by metal & plastic hybrids. So, there is a substantial competition in materials market for automotive applications. The growing environmental concerns are also speeding the need for lighter vehicle for lower fuel consumption and also for the need of recycling.

Thus, automotive industry is adapting commercially viable strategies like alternative metals and composites to serve the demand and sustain in the growing industry competition. But the bottleneck of the scenario for the industry is not only to serve the demand of lightweight vehicles and also might challenge vehicle standard regulations, nation’s infrastructural and economical issues.

Yet, there are significant barriers in large scale use of these materials mainly due to the cost of the raw materials or the large capital investment need for transformation of the forming processes and reaching the changing standards & regulations in the crash worthiness & reliability. So, there is need for further research for best viable processes, properties and lower cost materials to cash this lucrative industry at its peak.